- Created by Chun Kang, last modified on 2023-12-10

The next generation Insurtech offers just-in-time experience with consistent user engagement through digital tools based on internet and mobile that enables to know more about the persona based on the past and current history, so eventually they will get more quality and competitive products anywhere as the value of the integrated technologies.

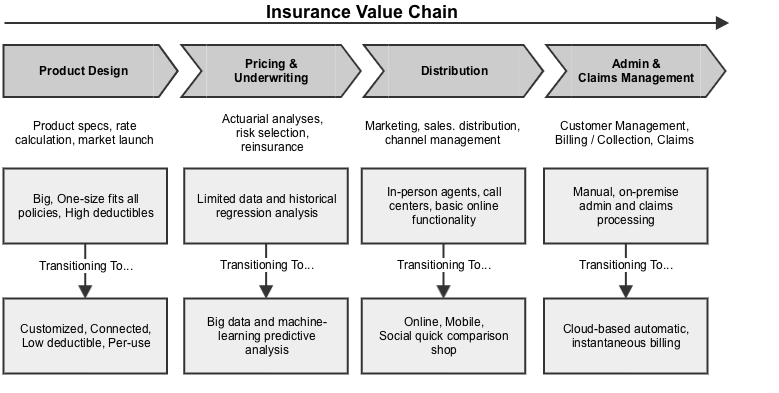

Below is Insurance Value Chain in terms of Technology's point of view.

1. What is Insurtech?

Insurtech is a combination of “insurance” and “technology” that was inspired by the term "fintech" (finance and technology), so the simplest answer is: Insurtech = insurance + technology.

2. Insurance Market Size

Insurance is a kind of common commodity in top rich countries everybody for emergency case. Among them, APAC is the biggest market on earth including China, India, Australia, Korea and Japan.

3. Insurtech Ecosystem

- 2016.02. Insurtech Ecosystem : why winning is hard and Changing is part of the game

- 2017.01. Insurance Technology Landscape from Venture Scanner

- 2018.11 Hong Kong FinTech 2018

- 2018.Q2. Insurance Technology Startup Highlights from Venture Scanner

- 2019.04. Insurance Technology Landscape from Venture Scanner

- 2019.Q2. Insurance Technology Landscape from Venture Scanner

4. Business Cases

- Automotive — Auto Insurance is growing fast in emerging markets as people get their first car. Telematics can create a more personalised risk premium. Claims processing is in transformation as auto body shops and consumers form into networks through maps and mobile phones. Meanwhile consensus is emerging that greater adoption of driver automation and augmentation will dramatically reduce insurance for the good news reason that it will dramatically reduce accidents and the sharing economy is reducing the numb

- Employee Benefits Platforms — The key goal on "Employee Benefits Platforms" area in terms of InsurTech's point of view is to provide a seamless online experiences for the employees.

- Enterprise/Commercial — In terms of technology point of view, most of leading start-ups making good progress on this area are offering the fully digitalized service in shortly without any paper-work as well as communications.

- Health Insurance — Health insurance is an insurance that covers the whole or a part of the risk of a person incurring medical expenses, spreading the risk over a large number of persons. By estimating the overall risk of health care and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organizat

- Life, Home, P&C — One of the biggest challenges in the fin-tech sector is to create a new business model for insurance based on behavioral economics and technology. They use artificial intelligence and chatbots to deliver insurance policies and handle claims for its users on desktop and mobile (through its iOS and Android applications) without employing the use of insurance brokers. Social good is another aspect of the business model, where underwriting profits go to nonprofits of the customers’ choice.

- P2P Insurance — Peer-to-Peer (P2P) insurance is a risk sharing network where a group of individuals pool their premiums together to insure against a risk. Peer-to-Peer Insurance mitigates the conflict that inherently arises between a traditional insurer and a policyholder when an insurer keeps the premiums that it doesn’t pay out in claims. P2P insurance may also be referred to as "social insurance."

- Reinsurance — Reinsurance, also known as insurance for insurers or stop-loss insurance, is the practice of insurers transferring portions of risk portfolios to other parties by some form of agreement to reduce the likelihood of paying a large obligation resulting from an insurance claim. The party that diversifies its insurance portfolio is known as the ceding party. The party that accepts a portion of the potential obligation in exchange for a share of the insurance premium is known as the reinsurer.

- Travel Insurance

5. Insurtech Solutions

- Chatbots — There are two different human races on earth at the moment: one is familiar with mobile devices and the other one is familiar with that. The second human race who is familiar with mobile devices tends to solve everything by themselves without any engagement, because there are lots of good helping tool for them such as AI and chatbots. Below diagram from Dion Hincliffe shows the concept of Chatbots based on AI.

- Customer Relationship Management — CRM(Customer Relationship Management) helps businesses build a relationship with their customers that, in turn, creates loyalty and customer retention. Since customer loyalty and revenue are both qualities that affect a company's revenue, CRM is a management strategy that results in increased profits for a business. At its core, a CRM tool creates a simple user interface for a collection of data that helps businesses recognize and communicate with customers in a scalable way. In order to maintai

- Insurance Data/Intelligence — From the business perspective, data collected from the operation can be used for decision making by analytics that contains some factual information with visual graphs, so we can make some insights.

- Insurance Infrastructure/Backend

- Insurance User Acquisition

- Robotic and Cognitive Automation (a.k.a. RPA) — R&CA is expected to foster greater collaboration between human and machine by both automating repetitive tasks and enhancing the quality of jobs. R&CA technology is now poised to unlock a world of possibilities through the synergistic combination of its key components.

6. Direction for Digital Transformation on Insurtech

What is happening now?

Recent space activity

Space contributors

- No labels