Auto Insurance is growing fast in emerging markets as people get their first car. Telematics can create a more personalised risk premium. Claims processing is in transformation as auto body shops and consumers form into networks through maps and mobile phones. Meanwhile consensus is emerging that greater adoption of driver automation and augmentation will dramatically reduce insurance for the good news reason that it will dramatically reduce accidents and the sharing economy is reducing the number of people whop buy cars (as opposed to simply using cars as needed).

Based on DailyFinTech Advisers in 2016, they found 21 ventures going after Auto Insurtech and put them into 4 categories

- Claims Process

- Comparison & Robo Brokers

- Just in Time Insurance

- Telematics

https://dailyfintech.com/2016/06/02/21-insurtech-ventures-changing-auto-insurance/

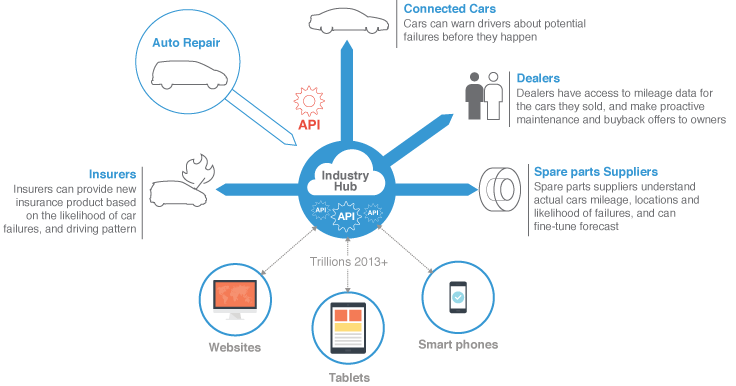

Below picture shows the potential opportunities in the future on Automotive Industry - the connectivity based on IoT will enable automated services and trigger automated engagement on Insurers, so the end-user will take that benefits without any intended actions.

Other InsuTech Business Cases